By : Mohamad Ashaari bin Awab K.B P.A

The definition of financial management is 'Is an organized way of planning and controlling expenses to meet life goals'. Therefore, the thing to pay attention to in controlling expenses is to also set financial goals by starting savings.

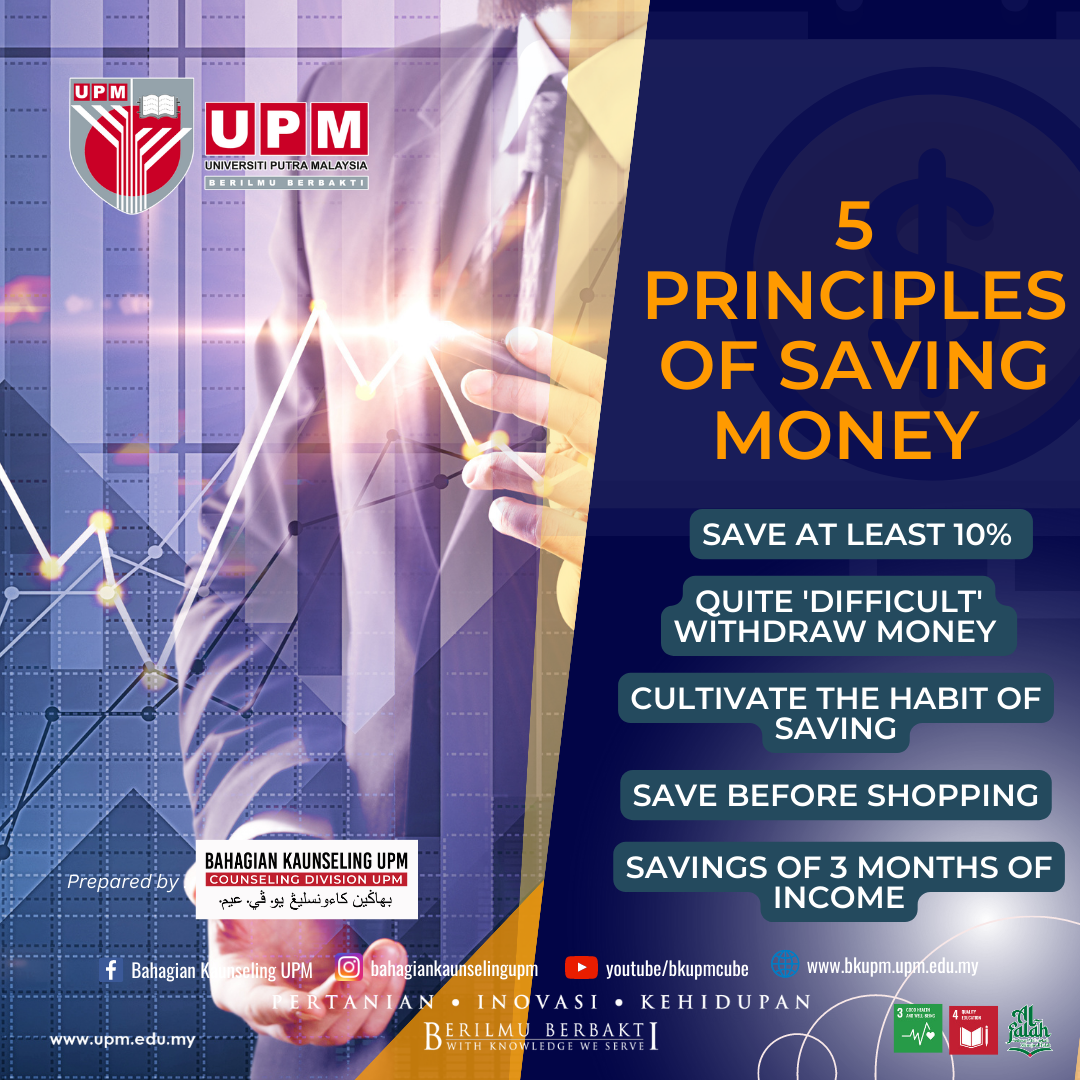

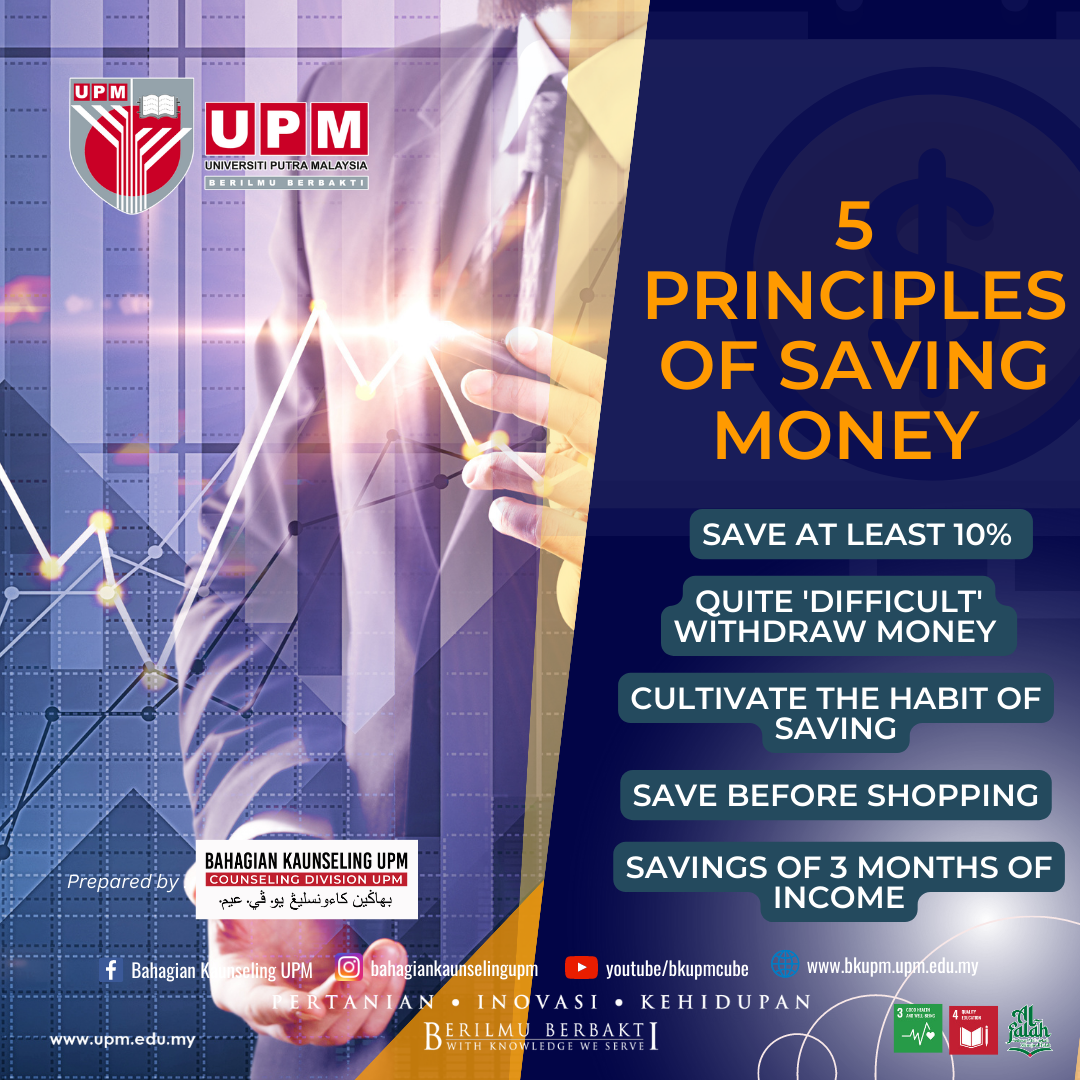

According to Mohd Zulkifli Shafie, a millionaire who is also the author of Wang Emas and Mission Bebas Tuang, there are several important principles that can be practiced to ensure that our financial goals are achieved. Among them are;

1. Save at least 10% of your monthly income

This 10% deposit must be used as a deposit to be forgotten. The meaning is, if we save it and don't remember it again. Until one time, the money from the savings can be used to double start a business or investment.

2. Deposits in places that are quite 'difficult' to be removed

Examples of storage places that are quite difficult to withdraw are Tabung Haji (no ATM card) and gold savings. According to him. If we save in Tabung Haji, we should never take the withdrawal facility through Bank Islam or Bank Rakyat ATMs. If it is easy to withdraw, the savings will not last long.

3. Cultivate the HABIT of saving

It doesn't matter how much we can save every month, the most important thing is to cultivate the HABIT of saving. If you can only save RM 20 a month, save the RM10 in a Haj fund or a place that is difficult to withdraw. As long as we don't save money, as long as we don't get rich!

4. Save before shopping.

This principle is very important, after receiving the salary, keep the money that we want to save first. Can automatically deduct the salary to ensure that the money can be 'saved' before it reaches our hands. The rest is just used for shopping. There is a very high risk of the money being spent if it is not separated early.

5. Set a savings goal of at least 3 months of income

The emergency fund is important as a preparation in case of unexpected things like losing a job due to health. However, if you are thinking of quitting your job and starting your own business, this emergency fund is also very important, but you must save at least one year of income as a preparation.

In conclusion, to save money, we need to have discipline like the example mentioned above. It is important as motivation for us to be consistent in achieving the set financial goals.

Date of Input: 29/06/2023 | Updated: 29/06/2023 | ayna

MEDIA SHARING