By : Mohamad Ashaari bin Awab K.B.;P.A.

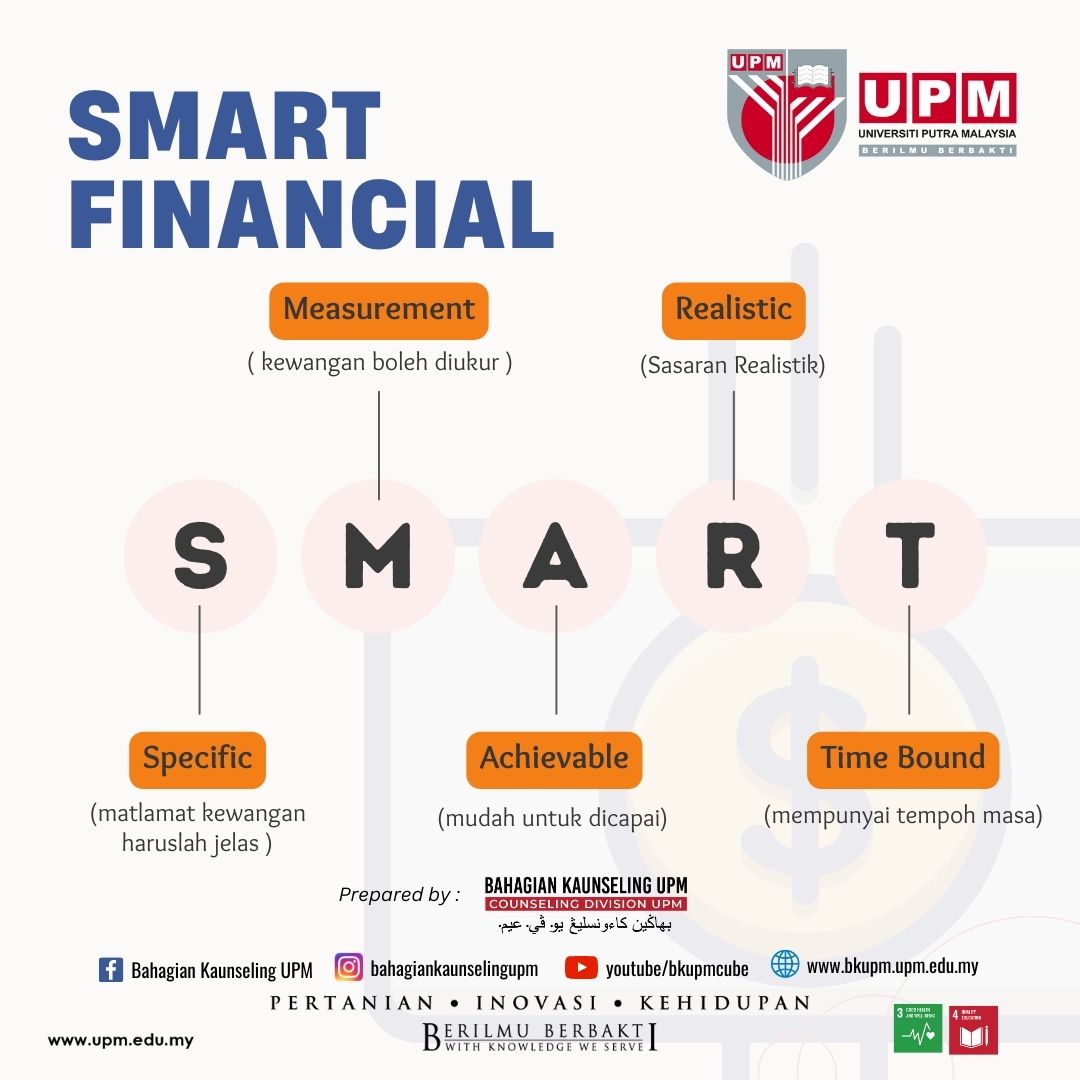

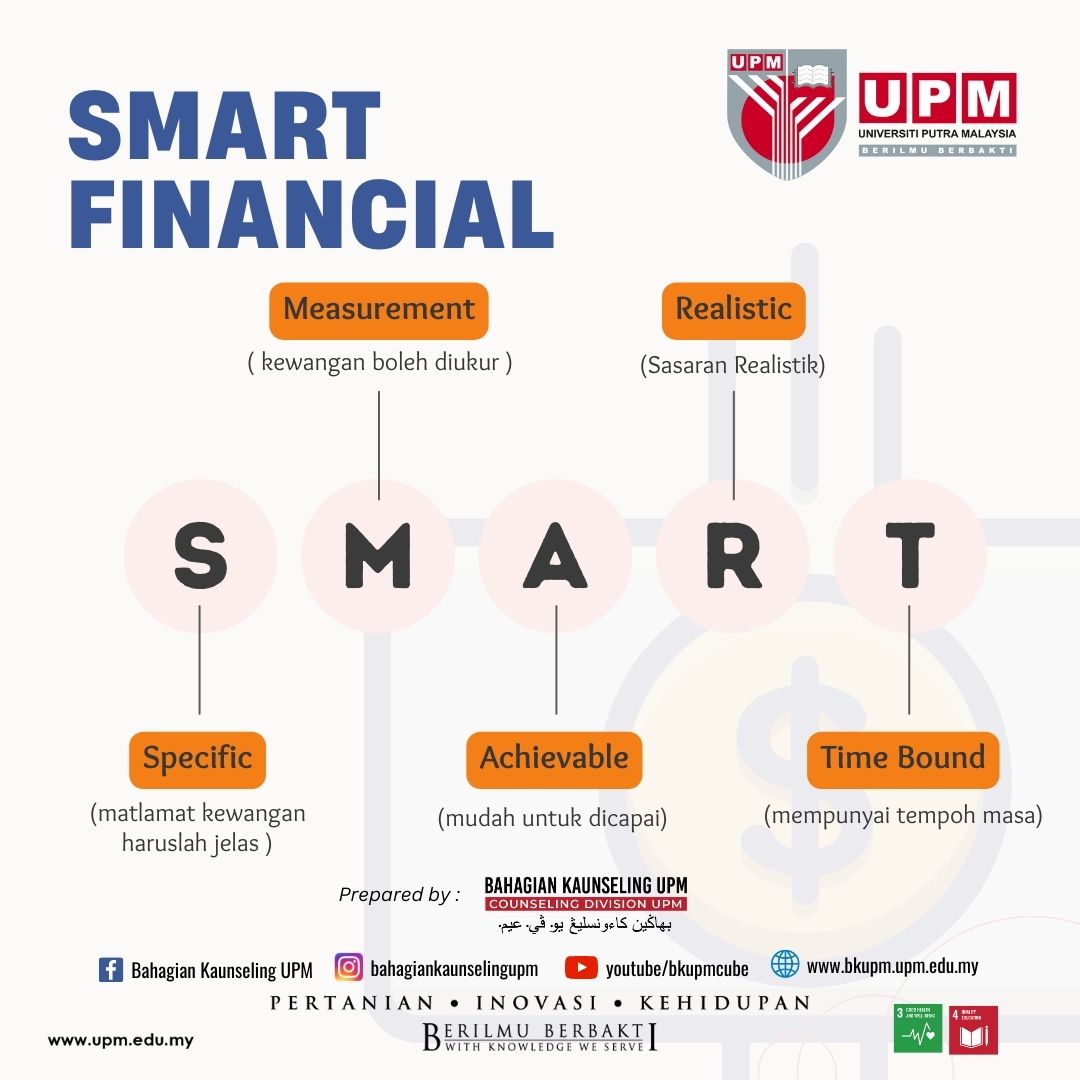

Each of us must have thought of having savings for a specific use in the future. It can be said to be a savings goal or a financial goal. Among the most popular financial goals are goals for saving a wedding fund, an emergency fund, saving for children's Education fund, saving for the purchase of a first home and even a retirement fund. Many have also started saving but eventually give up or fail to continue saving. How to prevent this from continuing? Haa.. here the writer wants to share tips so that your failure does not continue. This tip is called 'SMART Finance'. What is SMART Finance?. It is an organized and effective savings plan. Well, I give a situation like this; Mr. Haniff would like to have emergency savings. So how does Mr. Haniff want to achieve that financial goal?. This goal can be achieved by following the following four steps;

1. S = Specific

The first step, financial goals should be clear and specific. It is to make it easier for us to focus on what we want to achieve. For example, "I will have emergency savings" is more specific than "I will have enough savings".

2. M = Measurable

The second step, the financial goal should be a value that can be clearly measured. It is to allow us to measure the extent to which the savings goal has been achieved and then make it easier for us to evaluate the development of the financial goal. For example "I will have an emergency savings of three months of income" it is easier to measure than "I will have an emergency fund".

3. A = Achievable and R = Realistic

The next step is, financial goals should be something that is easy to achieve and realistic. For example, Mr. Lufti with an income of RM 3000 a month wants to save to build his 3-month emergency fund. So, how do you want to make your financial goals easy to achieve and realistic? It's simple, he just needs to set the monthly savings value according to the formula recommended by many financial experts, that is, monthly savings of 10% of the monthly income.

For example, "I will have an emergency savings of 3 months of income by saving 10% of my income every month" is something that is easy to achieve and realistic compared to "I will have an emergency savings of 3 months of income by saving 70% of my income every month".

4. T = Time-bound

The last step is, the financial goal that is made should have a clear time period to determine when the financial goal will be achieved. For example, "I will have an emergency savings of 3 months of income by saving 10% of my income every month for a period of 30 months".

In conclusion, financial goals will be easier to achieve if we have goals that are specific, measurable, easy to achieve, realistic values and also set a time period. Good luck.

Date of Input: 27/02/2024 | Updated: 27/02/2024 | ayna

MEDIA SHARING